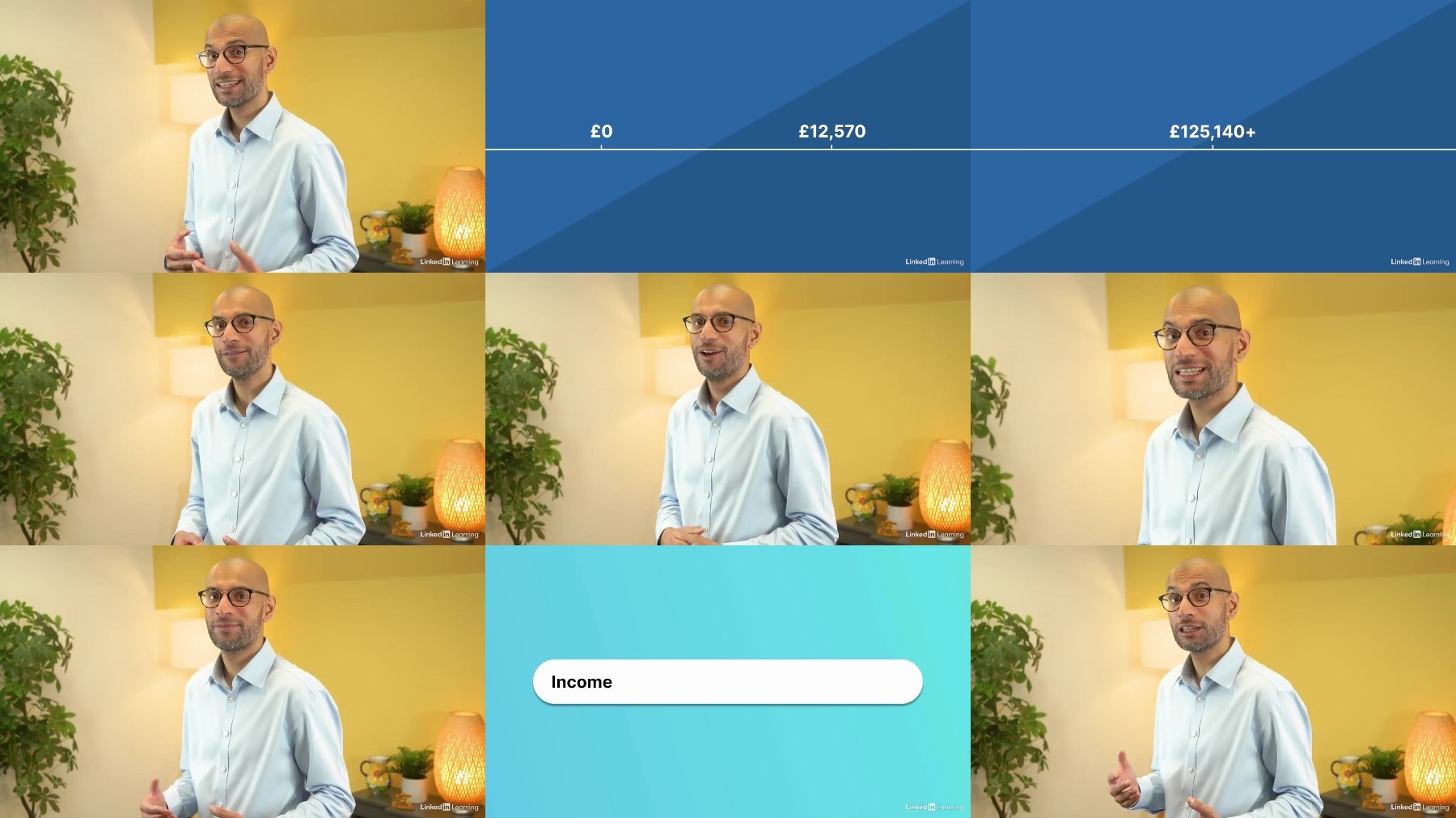

Understanding UK Personal Finance and Tax

Understanding UK Personal Finance and Tax

.MP4, AVC, 1280x720, 30 fps | English, AAC, 2 Ch | 1h 22m | 264 MB

Instructor: Naeem Anwar

Have you ever looked at your payslip and wondered what National Insurance is, why so much money has gone to your pension, or how your income tax is actually calculated? Maybe you have savings or an inheritance that you want to invest, or maybe you're claiming expenses and don't know what can and can't be claimed? In this course, join instructor Naeem Anwar, a chartered accountant with more than 20 years of experience, as he provides a comprehensive, no-nonsense guide to financial literacy specifically focused on the UK.

Explore all the financial terms and taxes that you need to know about to remain compliant as an individual. Naeem covers value-added tax (VAT), National Insurance, income tax, pension contributions, individual savings accounts (ISAs), self-employed tax and self-assessments, capital gains, stamp duty, and more, presenting the fundamentals in terms you can easily understand, so you'll never again look at your paycheck and scratch your head.

More Info

Free search engine download: Understanding UK Personal Finance